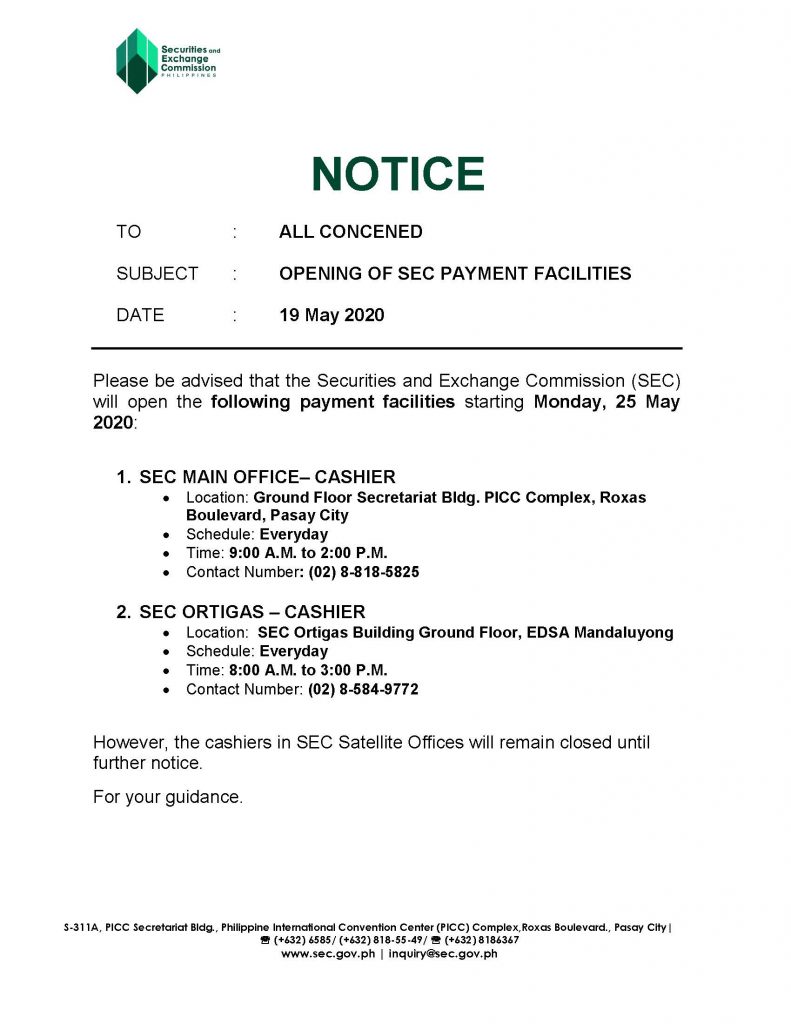

SEC Notice 19 May 2020

OPENING OF SEC PAYMENT FACILITIES

By Management

SEC Notice 19 May 2020

OPENING OF SEC PAYMENT FACILITIES

By Management

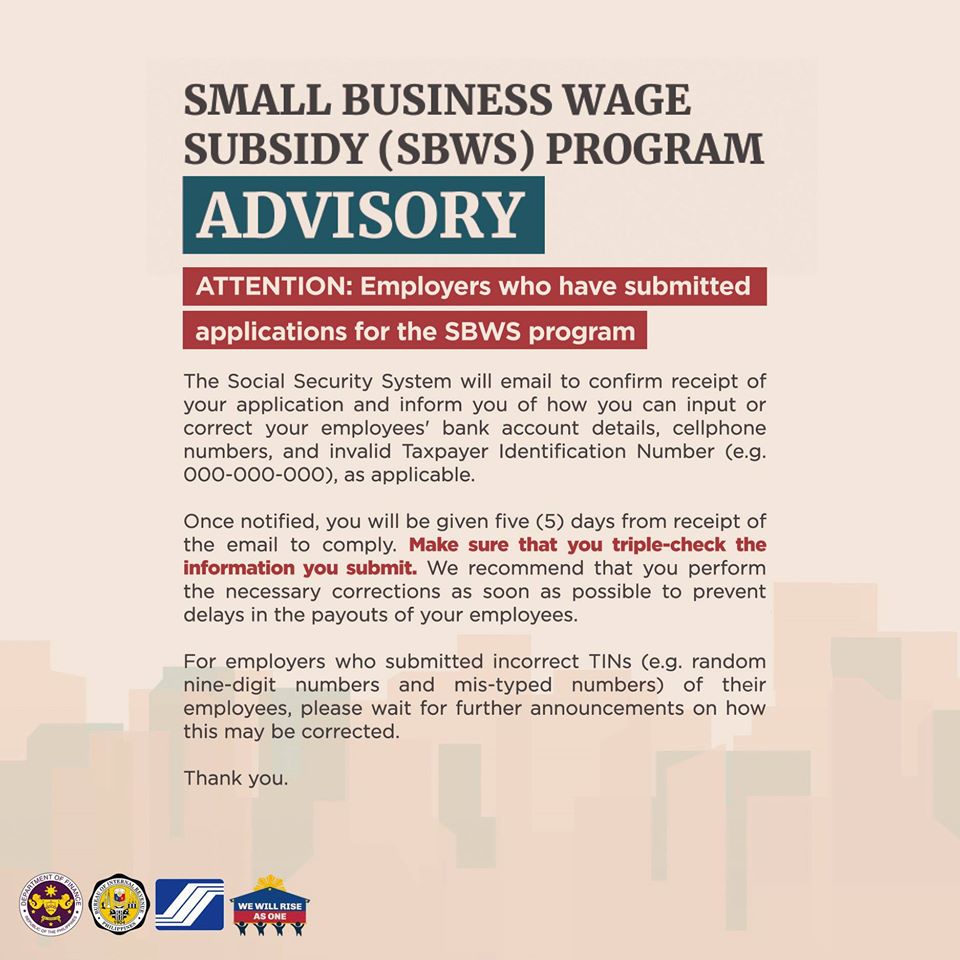

SSS Advisory: Small Business Wage Subsidy (SBWS) Program

ATTENTION: Employers who have submitted applications for the SBWS program

The Social Security System will email to confirm receipt of your application and inform you of how you can input or correct your employees’ bank account details, cellphone numbers, and invalid Taxpayer Identification Number (e.g. 000-000-000), as applicable.

Once notified, you will be given five (5) days from receipt of the email to comply. Make sure that you triple-check the information you submit. We recommend that you perform the necessary corrections as soon as possible to prevent delays in the payouts of your employees.

When encoding corrections, please remember the following:

• Bank account and mobile numbers must be active and should not be shared between two people; duplicate accounts/numbers will be rejected.

• Mobile numbers should be written as: 09171234567 or 09181234567. Do not use +63, dash, spaces or other special characters.

• For PayMaya accounts, input the employee’s correct Mobile number in the format 09171234567 or 09181234567. Do not put any other special characters like, #, dash, spaces, slash. Only input cellphone numbers currently linked to active PayMaya accounts.

• Bank account numbers should be written as a continuous string of numbers (e.g. 1234567890). Do not put a dash (-) in between numbers or any non-numeric character (e.g. #, /).

• TINs should be written with no spaces or characters between numbers. 000000000 or random nine-digit numbers are not acceptable as TINs. As we are promoting compliance, providing invalid and incorrect TINs may result in the forfeiture of the subsidy.

For employers who submitted incorrect TINs (e.g. random nine-digit numbers and mistyped numbers), please wait for further announcements on how this may be corrected.

Employers are reminded of their sworn undertaking to provide truthful and accurate information in their SBWS application.

By Management

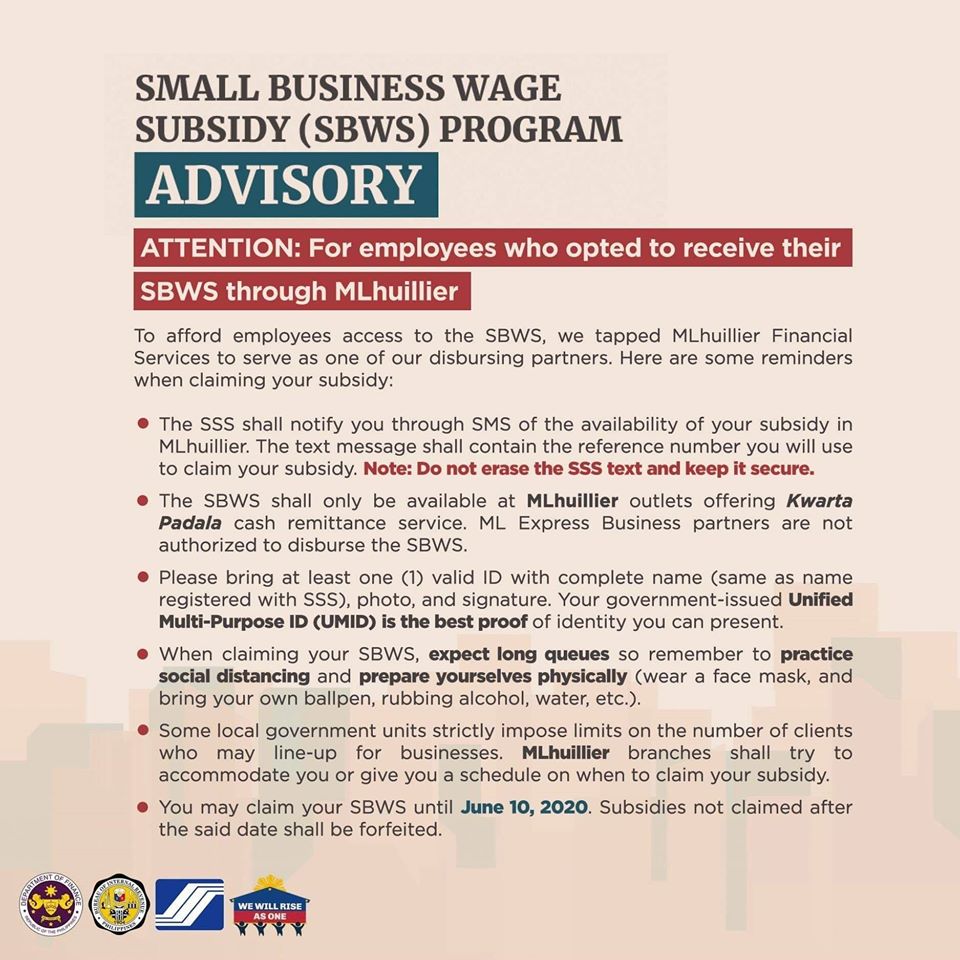

SSS Advisory: Small Business Wage Subsidy (SBWS) Program

Small Business Wage Subsidy (SBWS) Program

ADVISORY

ATTENTION: For employees who opted to receive their SBWS through MLhuillier

To afford employees access to the SBWS, we tapped MLhuillier Financial Services to serve as one of our disbursing partners.

Here are some reminders when claiming your subsidy:

• The SSS shall notify you through SMS of the availability of your subsidy in MLhuillier. The text message shall contain the reference number you will use to claim your subsidy. Note: Do not erase the SSS text and keep it secure.

• The SBWS shall only be available at MLhuillier outlets offering Kwarta Padala cash remittance service. ML Express Business partners are not authorized to disburse the SBWS.

• Please bring at least one (1) valid ID with complete name (same as name registered with SSS), photo, and signature. Your government-issued Unified Multi-Purpose ID (UMID) is the best proof of identity you can present.

• When claiming your SBWS, expect long queues so remember to practice social distancing and prepare yourselves physically (wear a face mask, and bring your own ballpen, rubbing alcohol, water, etc.).

• Some local government units strictly impose limits on the number of clients who may line-up for businesses. MLhuillier branches shall try to accommodate you or give you a schedule on when to claim your subsidy.

• You may claim your SBWS until June 10, 2020. Subsidies not claimed after the said date shall be forfeited.

By Management

By Management