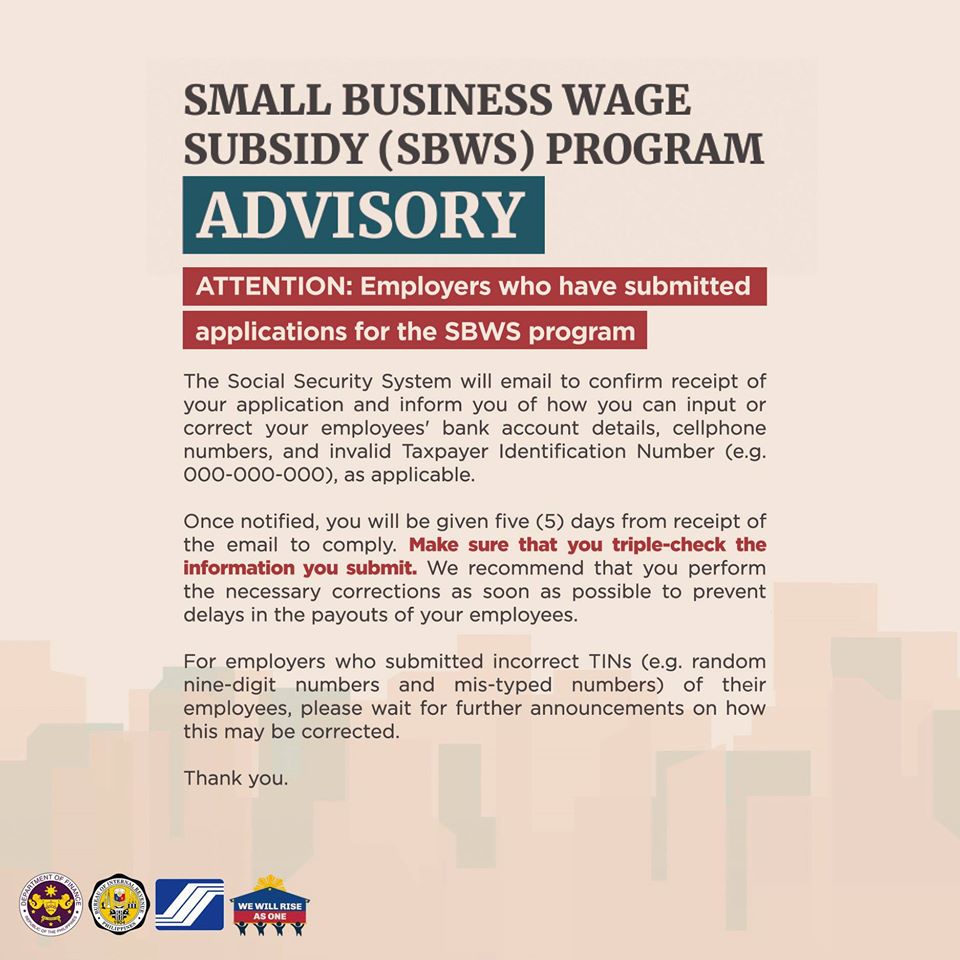

SSS Advisory: Small Business Wage Subsidy (SBWS) Program

ATTENTION: Employers who have submitted applications for the SBWS program

The Social Security System will email to confirm receipt of your application and inform you of how you can input or correct your employees’ bank account details, cellphone numbers, and invalid Taxpayer Identification Number (e.g. 000-000-000), as applicable.

Once notified, you will be given five (5) days from receipt of the email to comply. Make sure that you triple-check the information you submit. We recommend that you perform the necessary corrections as soon as possible to prevent delays in the payouts of your employees.

When encoding corrections, please remember the following:

• Bank account and mobile numbers must be active and should not be shared between two people; duplicate accounts/numbers will be rejected.

• Mobile numbers should be written as: 09171234567 or 09181234567. Do not use +63, dash, spaces or other special characters.

• For PayMaya accounts, input the employee’s correct Mobile number in the format 09171234567 or 09181234567. Do not put any other special characters like, #, dash, spaces, slash. Only input cellphone numbers currently linked to active PayMaya accounts.

• Bank account numbers should be written as a continuous string of numbers (e.g. 1234567890). Do not put a dash (-) in between numbers or any non-numeric character (e.g. #, /).

• TINs should be written with no spaces or characters between numbers. 000000000 or random nine-digit numbers are not acceptable as TINs. As we are promoting compliance, providing invalid and incorrect TINs may result in the forfeiture of the subsidy.

For employers who submitted incorrect TINs (e.g. random nine-digit numbers and mistyped numbers), please wait for further announcements on how this may be corrected.

Employers are reminded of their sworn undertaking to provide truthful and accurate information in their SBWS application.