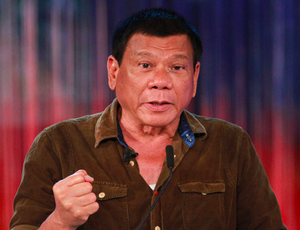

As Philippine president-elect Rodrigo Duterte prepares to take office on June 30, investors and business people both at home and abroad are wary of how the audacious politician will impact the country’s booming economy. Under President Aquino, the Philippines enacted several liberal macroeconomic reforms and experienced an average GDP growth rate of 6.2 percent, leading the Oxford Business Group to name the country the best economy in South East Asia. However, widespread anger over elitism, corruption, inequality, and crime catapulted the controversial politician to the country’s highest office despite little explanation of his economic policies.

Duterte has made international headlines for his crude and seemingly off-the-cuff anti-establishment remarks, while drawing anxiety from some corners due to his uncompromising tough on crime approach and implicit support for extrajudicial vigilante killings, giving him the monickers “Duterte Harry” and “The Punisher”. His populist campaigning, self-description as a socialist, lack of commitment to the rule of law, and remarks that he does not know much about economics or care about the stock market have unnerved investors who fear a reversal of the previous administration’s liberal economic reforms.

To allay these anxieties, Duterte recently announced an eight-point economic plan setting out his agenda to maintain the Philippines’ vigorous growth. The plan addresses rural development, tax reform, corruption, education, tourism, ease of doing business, foreign investment, and public-private partnerships.

Despite Duterte’s fiery and unpredictable rhetoric, he appears set to continue former president Benigno Aquino’s reforms and further open up the Philippines to foreign investment. While Duterte’s presidency promises to be eventful and campaign pledges may not ultimately be wholly fulfilled, investors can take solace in his reassurances to the business community and commitment to attracting foreign investment.

Law and Order

Duterte’s principal campaign promise to strengthen law and order features prominently in his economic plans. Duterte contends that eliminating gangs and organized crime will reassure investors wary of entering the Philippines due to concerns over their own personal safety. He touts his experience as mayor of Davao, where rampant lawlessness once earned the city the designation the “Nicaragua of Asia”, but now boasts the lowest crime rates in the country and strong foreign investment.

In addition to expunging urban crime, Duterte has pledged to quell ongoing conflicts and insurgencies with Islamist and Communist rebels in the South, principally on the island of Mindanao. While Duterte is notoriously ruthless on crime, even admitting to killing criminals himself, he has signaled his openness to enter peace talks with rebels. If successful, he plans to promote the area – the Philippines’ second largest island and home to over 20 million people – for tourism, agriculture, and infrastructure investment.