A Philippine tax amnesty program has been proposed by senate minority leader Ralph Recto in an effort to increase state collections and mitigate reduced revenues that are projected to come in the wake of planned corporate tax reductions. Announced formally on the 20th of September, changes will now be considered by the national assembly prior to their implementation. If passed the amnesty will take effect 15 days from this date and be available for 6 months from this date.

Details of the Amnesty

Applicable to corporations, individuals, and other entities operating in the Philippines, the proposed tax amnesty will be applied to all outstanding taxes from the fiscal year of 2015 and all years prior. Under the program, those successfully applying will be immune from civil, criminal, and administrative penalties stemming from their outstanding tax obligations.

RELATED: Tax Compliance Services from Dezan Shira & Associates

How to Qualify for Relief Under the Amnesty

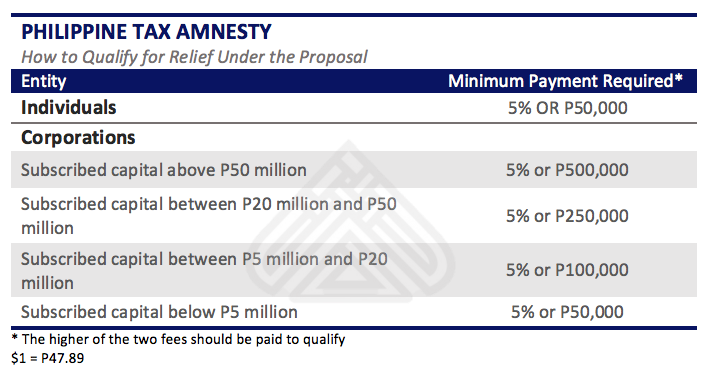

To gain immunity and to start afresh with tax authorities, parties will be required to pay a limited portion of their outstanding debts within 6 months of the amnesty’s implementation. This payment will consist of 5 percent of the total amount owed or a flat fee (whichever is higher). While fees are fixed for individuals, they vary for corporation depending on their subscribed capital. A breakdown of all required fees are outlined below:

RELATED: Philippines Set to Lower Corporate Income Tax under Duterte

Parties Prohibited from Applying for Amnesty

while the amnesty is generally open to all parties within the Philippines, there are a number of cases in which the amnesty would not apply. Generally covering those that are currently being invested or are in some way caught up in government related litigation, the following are specific cases that are specified within the proposal:

- Those with pending cases falling under the jurisdiction of the Presidential Commission on Good Government

- Those with pending cases involving unexplained or unlawfully acquired wealth and other issues covered under the Anti-Graft and Corrupt Practices ACT

- Those with pending cases involving violation of the Anti-Money Laundering Act

- Those with pending criminal cases for tax evasion

Complete information related to the amnesty can be found in the text of the proposal (available here). For further clarification on elements of the amnesty program or general tax compliance within the Philippines, please get in contact with tax specialists at asean@dezshira.com

Implications for Investment

With some of the highest levels of taxation in ASEAN, the Philippines has expressed plans to reduce taxation in under the Duterte administration. Although popular for investors, the reduction of taxes will do little to combat a culture of tax evasion that has persisted within the Philippines. If implemented effectively, the amnesty could usher in a new era of participation in Philippine taxation and pave the way for sustainable reductions in taxation down the line.

While the amnesty program seems to be at odds with the Duterte administration’s penchant for rule of law, it should be recalled that even drug dealers were given a period of time to come forward prior to the government’s current crackdown. Should the amnesty come to pass, those with outstanding obligations should seriously consider their options.