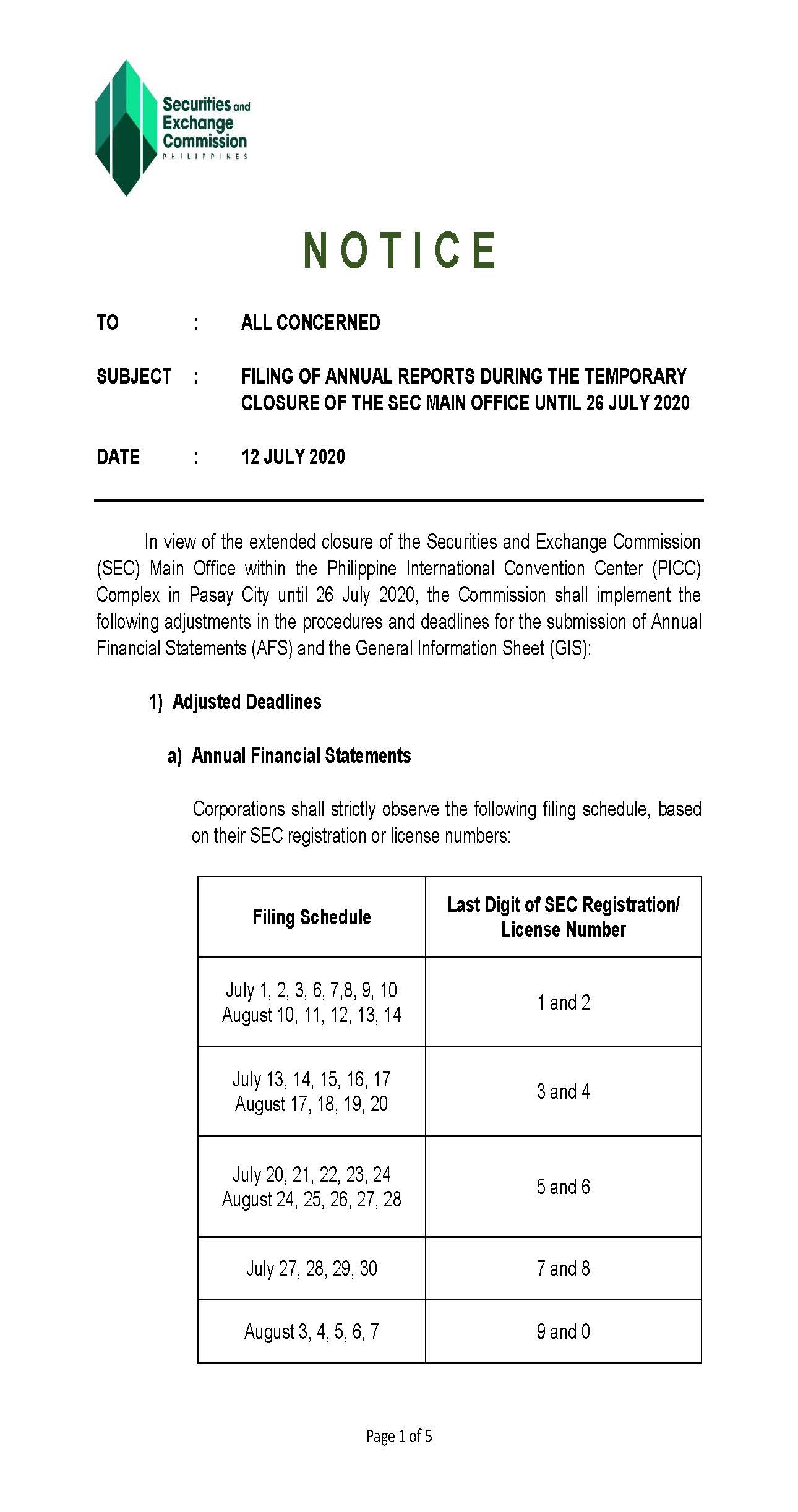

SEC Notice (July 12, 2020)

FILING OF ANNUAL REPORTS DURING THE TEMPORARY CLOSURE OF THE SEC MAIN OFFICE UNTIL 26 JULY 2020

By Management

By Management

By Management

BIR REVENUE MEMORANDUM ORDER NO. 21-2020

issued on July 10, 2020 prescribes the policies, guidelines and procedures for the inspection or supervision of the destruction/disposal and determination of deductible expense pertaining to inventory of goods/assets which have been declared as waste or obsolete. The “Application for Destruction/Disposal of Goods/Assets” shall be filed with and processed by the concerned Large Taxpayer (LT) Office or Revenue District Office (RDO) where the principal place of business of the taxpayer is registered. The said Application shall be filed by the taxpayer in duplicate copies, together with complete documentary requirements listed in the Order, at least seven (7) days before the proposed scheduled date of destruction/disposal of the inventories/equipment. Only applications with complete documents shallbe processed by the concerned Office. The BIR shall inform the taxpayer applicant within five (5) days from receipt of application as to the approved manner of witnessing and schedule of destruction/ disposal. If the method approved is through a third party, the Bureau shall issue a letter to the third party, through the taxpayer, within the same period. All expenses incidental

to the witnessing shall be for the account of the taxpayer. In the event that the destruction/disposal activity cannot be completed in one (1) day, the same may be scheduled in a manner acceptable to both the taxpayer and the BIR or BIR authorized representative until the total volume applied for has been entirely destroyed or disposed of. The date of the destruction shall be scheduled on regular working days. However, destruction may be conducted on a weekend or on a nonworking holiday subject to prior approval by the BIR. The valuation that will be used for the inventory or assets to be disposed/ destructed shall be the actual cost. If the actual cost cannot be accurately determined, the inventory valuation maintained and used by the taxpayer shall be adopted subject to adjustment upon verification during the audit. In the case of fixed assets, the carrying

book value shall be considered. Deduction of losses for Income Tax purposes arising from inventory destruction or disposal shall be allowed after witnessing in accordance with this Order and issuance of the “Certificate of Deductibility of Goods/Assets Destructed/Disposed”. The BIR shall issue the said certificate within five (5) days from the date of submission by the taxpayer of the complete documents (e.g. photos and videos, inventory count sheet, etc.) of destruction/disposal. In case the inventories/assets applied for disposal are, for any reason or cause, replaced/substituted by its supplier, or the taxpayer shall become entitled to

reimbursement for the partial or equivalent value thereof by an insurance company, the claim for the deductibility of the value thereof shall be denied. In case any discrepancy is discovered in the course of the evaluation and verification of the application for deductibility, and that it was determined that the taxpayer has already claimed such deductions for Income Tax purposes, the taxpayer shall be subjected to mandatory audit. Any scrap or salvage value, as may be subsequently determined, shall be declared as other income. The corresponding reports bearing on the results of inventory destruction as well as the “Certificate of Deductibility of Goods/Assets Destructed/Disposed” shall be approved by the Assistant Commissioner-Large Taxpayers Service (LTS) or Regional Director, which may be delegated in writing to the Division Chiefs of the LT Office/RDO

having jurisdiction over the applicant-taxpayer. Destruction/disposal of goods, products and articles subject to Excise Tax shall be witnessed/validated by the authorized BIR official from the Excise Tax Divisions of the LTS.

be processed by the concerned Office. The BIR shall inform the taxpayer-applicant within five (5) days from receipt of application as to the approved manner of witnessing and schedule of destruction/disposal. If the method approved is through a third party, the Bureau shall issue a letter to the third party, through the taxpayer, within the same period. All expenses incidental

to the witnessing shall be for the account of the taxpayer. In the event that the destruction/disposal activity cannot be completed in one (1) day, the same may be scheduled in a manner acceptable to both the taxpayer and the BIR or BIR authorized representative until the total volume applied for has been entirely destroyed or disposed of. The date of the destruction shall be scheduled on regular working days. However, destruction may be conducted on a weekend or on a nonworking holiday subject to prior approval by the BIR. The valuation that will be used for the inventory or assets to be disposed/destructed shall be the actual cost. If the actual cost cannot be accurately determined, the inventory valuation maintained and used by the taxpayer shall be adopted subject to adjustment upon verification during the audit. In the case of fixed assets, the carrying

book value shall be considered. Deduction of losses for Income Tax purposes arising from inventory destruction or disposal shall be allowed after witnessing in accordance with this Order and issuance of the “Certificate of Deductibility of Goods/Assets Destructed/Disposed”. The BIR shall issue the said certificate within five (5) days from the date of submission by the taxpayer of the complete documents (e.g. photos and videos, inventory count sheet, etc.) of destruction/disposal. In case the inventories/assets applied for disposal are, for any reason or cause, replaced/substituted by its supplier, or the taxpayer shall become entitled to

reimbursement for the partial or equivalent value thereof by an insurance company, the claim for the deductibility of the value thereof shall be denied. In case any discrepancy is discovered in the course of the evaluation and verification of the application for deductibility, and that it was determined that the taxpayer has already claimed such deductions for Income Tax purposes, the taxpayer shall be subjected to mandatory audit. Any scrap or salvage value, as may be subsequently determined, shall be declared as other income. The corresponding reports bearing on the results of inventory destruction as well as the “Certificate of Deductibility of Goods/Assets Destructed/Disposed” shall be approved by the Assistant Commissioner-Large Taxpayers Service (LTS) or Regional Director, which may be delegated in writing to the Division Chiefs of the LT Office/RDO

having jurisdiction over the applicant-taxpayer. Destruction/disposal of goods, products and articles subject to Excise Tax shall be witnessed/validated by the authorized BIR official from the Excise Tax Divisions of the LTS.

By Management

BIR REVENUE REGULATIONS NO. 19-2020

issued on July 8, 2020prescribes the use of the new BIR Form No. 1709 (Information Return on Related Party Transactions [Domestic and/or Foreign]), replacing BIR Form No. 1702H, Series of 1992(Information Return on Transactions with Related Foreign Persons). For tax purposes, there should be an effective implementation of Philippine Accounting Standards (PAS) 24, Related Party disclosures. Under this PAS, an entity’s financial statements shall contain the disclosures necessary to draw attention to the possibility that its financial position and profit or loss may have been affected by the existence of related parties and by transactions and outstanding balances, including commitments, with such parties. The submission of BIR Form No. 1709 and its supporting documents is required following the guidelines prescribed by the related revenue issuances for the submission of the required attachments to the Annual Income Tax Returns.

Tax examiners are enjoined to conduct a thorough examination of the related party transactions and see to it that revenues are not understated and expenses are not overstated in the financial statements as a result of these transactions.

In determining whether a person or entity is a related party, the following rules shall be considered:

a. A person or a close member of that person’s family is related to a reporting entity if that person:

i. has control or joint control of the reporting entity;

ii. has significant influence over the reporting entity; or

iii. is a member of the key management personnel of the reporting entity or of a parent of the reportingentity.

b. An entity is related to a reporting entity if any of the following conditions applies:

i. The entity and the reporting entity are members of the same group (which means that each parent, subsidiary and fellow subsidiary is related to the others).

ii. One entity is an associate or joint venture of the other entity (or an associate or joint venture of a member of a group of which the other entity is a member).

iii. Both entities are joint ventures of the same third party.

iv. One entity is a joint venture of a third entity and the other is an associate of the third entity.

v. The entity is a post-employment benefit plan for the benefit of employees of either the reporting entity or an entity related to the reporting entity. If the reporting entity is itself such a plan, the sponsoring employers are also related to the reporting entity.

vi. The entity is controlled or jointly controlled by a person identified in (a).

vii. A person identified in (a)(i) has significant influence over the entity or is a member of the key management personnel of the entity (or of a parent of the entity).

viii. The entity, or any member of a group of which it is a part. provides key management personnel services to the reporting entity or to the parent of the reporting entity.

In all cases, the substance of relationships between entities shall be taken into account and not merely the legal form. On the other hand, related party transactions shall include, but not limited to, the following:

a. purchases or sales ofgoods (finished or unfinished);

b. purchases or sales ofproperty and other assets;

c. rendering or receiving of services;

d. leases;

e. transfers of research and development;

f. transfers under license agreements;

g. transfers under finance arrangements (including loans and equity contributions in cash or in kind);

h. provision of guarantees or collateral;

i. commitments to do something if a particular event occurs or does not occur in the future, including executory contracts, i.e., contracts under which neither party has performed any of its obligations or both parties have partiallyperformed their obligations to an equal extent (recognized and unrecognized); and

j. settlement of liabilities on behalf of the entity or by the entity on behalf of that related party.

The following requirements shall be observed bythe taxpayer, who may either be a reporting entity or a related party:

a. The required disclosures on transactions and outstanding balances shall be made separately for each of the following categories:

i. the parent;

ii. entities with joint control or significant influence over the entity;

iii. subsidiaries;

iv. associates;

v. joint ventures in which the entity is a joint venturer;

vi. key management personnel of the entity or its parent; and

vii. other related parties

b. For each of said category, the following information shall be provided:

i. the amount of the transactions;

ii. the amount of outstanding balances, including commitments, and their termsand conditions, including whether they are secured, and the nature of theconsideration to be provided in settlement, and details of any guaranteesgiven or received;

iii. provisions for doubtful debts related to the amount of outstanding balances;

iv. the expense recognized during the period in respect ofbad or doubtful debtsdue from related parties

In filling out BIR Form No. 1709, the taxpayer is directed to observe the following:

a. BIR Form No. 1709 shall be completely and truthfully accomplished by thetaxpayer or its authorized representative/s,and shall be attached to the ITRs for thecurrent taxable year and subsequent years, making it an integral part of the latter.

b. The nature oftransaction and the accounts affected shall be described in detail.

c. The “business overview of the ultimate parent company” referred to in Part IV(A)of BIR Form No. 1709 shall include the profile of the multinational group of which the taxpayer belongs, along with the name, address, legal status and country of taxresidence of each of the related parties with whom intra-group transactions havebeen entered into by the taxpayer, and ownership linkages among them.

d. The “functional profile” referred to in Part IV(B) of BIR FormNo. 1709 shall include a broad description of the business of the taxpayer and theindustry in which it operates, and of the business of the related parties with whomthe taxpayer has transacted;

e. The following are required to be attached to BIR Form No. 1709:

i. certified true copy of the relevant contracts or proof of transaction;

ii. withholding tax returns and the corresponding proof of payment of taxeswithheld and remitted to the BIR;

iii. proof of payment of foreign taxes or ruling duly issued by the foreign taxauthority where the other party is a resident; and

iv. certified true copy of Advance Pricing Agreement, if any; and

v. any transfer pricing documentation.

f. No spaces shall be left unanswered. If one or some portions are not applicable, such fact shall be so stated.

By Management

BIR Revenue Regulation No. 18-2020

issued on July 8, 2020 implements Section 1 of Republic Act (RA) No. 11467, further amending Section 109(AA) of the National Internal Revenue Code (NIRC) of 1997, as amended by RA No. 10963 (TRAIN Law), providing for Value-Added Tax (VAT) Exemption on the sales and importation of drugs and medicines prescribed for diabetes, high cholesterol, hypertension, cancer, mental illness, tuberculosis and kidney diseases.

Section 4.109-1 of Revenue Regulations (RR) No. 16-2005, as amended by RR No. 13-2018, is further amended to read as follows:

“SEC. 4.109-1. VAT-Exempt Transactions. —

(B) Exempt transactions. —

(l) Subject to the provisions of Section 4.109-2 hereof, the following transactions shall be exempt from VAT:

(aa) Sale or importation of prescription drugs and medicines for:

(i) Diabetes, high cholesterol, and hypertension beginning January 1, 2020; and

(ii) Cancer, mental illness, tuberculosis, and kidney diseases beginning January 1, 2023.

The exemption from VAT under this subsection shall only apply to the sale or importation by the manufacturers, distributors, wholesalers and retailer of drugs and medicines included in the “list of approved drugs and medicines” issued by the Department of Health (DOH) for this purpose.

The VAT on importation of prescription drugs and medicines for diabetes, high cholesterol and hypertension included in the DOH-Food and Drug Administration (DOH-FDA) approved list from the effectivity of RA No. 11467 on January 27, 2020 until the effectivity of these Regulations, shall be refunded pursuant to Section 204(C) of the Tax Code of 1997, as amended, in accordance with the existing procedures for refund of VAT on importation, provided that the input tax on the imported items have not been reported and claimed as input tax credit in the monthly and/or quarterly VAT returns. The same shall not be allowed as input tax credit pursuant to Section 110 of the Tax Code of 1997, as amended, for purposes of computing the VAT payable of the concerned taxpayer/s for the said period.