SEC Notice 29 April 2020

EXTENSION OF THE MANDATORY GRACE PERIOD FOR LOANS DURING THE EXTENDED ENHANCED COMMUNITY QUARANTINE PERIOD

By Management

SEC Notice 29 April 2020

EXTENSION OF THE MANDATORY GRACE PERIOD FOR LOANS DURING THE EXTENDED ENHANCED COMMUNITY QUARANTINE PERIOD

By Management

By Management

By Management

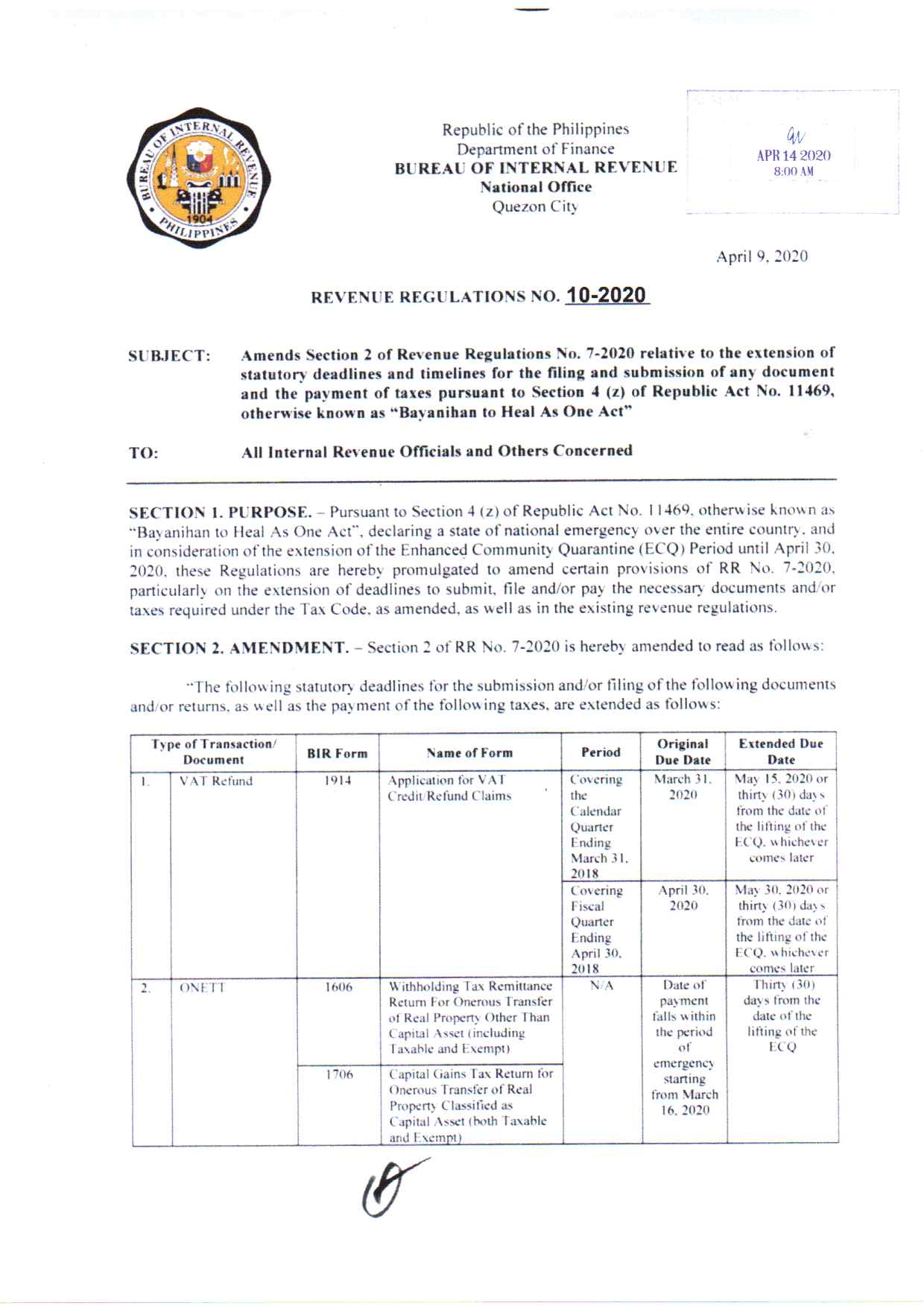

BIR Revenue Regulations No. 10-2020

REVENUE REGULATIONS NO. 10-2020 issued on April 14, 2020 amends Section 2 of Revenue Regulations No. 7-2020 by further extending the statutory deadlines and timelines for the filing and submission of various tax returns and/or documents and the payment of taxes specified in these Regulations, as a result of the extension of the Enhanced Community Quarantine (ECQ) period until April 30, 2020.

If the new extended due dates fall on a holiday or non-working day, then the submission and/or filing considered in these Regulations shall be made on the next working day. If the ECQ period will be extended further, the filing of the returns and payment of the corresponding taxes due thereon, and submission of reports and attachments falling within the enhanced extended period shall be extended for thirty (30) calendar days from the lifting of the ECQ.

Taxpayers who will file their tax returns within the original deadline or prior to the extended deadline can amend their tax returns at any time on or before the extended due date. An amendment that will result in additional tax to be paid can still be paid without the imposition of corresponding penalties (surcharge, interest and compromise penalties) if the same shall be done not later than the extended deadline as provided under existing rules and regulations. A taxpayer whose amended returns will result in overpayment of taxes paid can opt to carry over the overpaid tax as credit against the tax due for the same tax type in the succeeding periods tax returns, aside from filing for claim for refund.

By Management

BIR Revenue Regulations No. 9-2020

REVENUE REGULATIONS NO. 9-2020 issued on April 7, 2020 implements Section 4 (z) and Section 4 (ee) of Republic Act No. 11469 (Bayanihan to Heal as One Act) by granting further benefits on donations during the period of Enhanced Community Quarantine (ECQ) in relation to the National Internal Revenue Code (NIRC) of 1997, as amended. The following donations/gifts made in accordance with Sections 101 and 34 (H), of the NIRC of 1997, as amended, when given for the sole and exclusive purpose of combating COVID- 19 during the period of the state of national emergency under RA No. 11469, shall be considered fully deductible against the gross income of the donor-corporation/donor-individual:

a. Cash donations;

b. Donations of all critical or needed healthcare equipment or supplies;

c. Relief goods such as, but not limited to, food packs (rice, canned goods, noodles, etc.) and water; and

d. Use of property, whether real or personal (shuttle service, use of lots/ buildings).

Moreover, donation of any of the above exempt donations/gifts to the National Government or to any of its agencies or political subdivisions, including fully-owned government corporations, for the sole and exclusive purpose of combating the COVID-19, shall be allowed full deductibility, regardless if covered by the National Economic and Development Authority (NEDA)’s annual priority plan, considering that such donations are made during State of Public Health Emergency and State of Calamity as declared under Presidential Proclamation Nos. 922 and 929, series of 2020. The requirement of submission of a Notice of Donation shall be dispensed

with for this purpose Furthermore, all donations/gifts mentioned in a, b, c, and d above, when donated during the period of the state of national emergency for the sole and exclusive purpose of combating COVID-19, subject to the timely submission of the documentary requirements enumerated under Section 6 of these regulations, shall also be considered as exempt from the Donor’s Tax and shall be deductible in full against the gross income of the donor-corporation and/or donor-individual when given to the following donees:

a. Private hospitals and/or non-stock non-profit educational and/or charitable, religious, cultural or social welfare corporation, institution, foundation, non-government organization (NGO) (even if non-accredited), trust or philanthropic organization and/or research institution or organization; and

b. Local private corporations, civic organizations, and/or international organizations/institutions provided that they shall i) actually, directly and exclusively distribute and/or transfer said donations/gifts to, and/or ii) partner as conduit/logistical machinery with the accredited NGOs and/or national government or any entity created by any of its agencies which is not conducted for profit, or to any political subdivision of the said Government.

Said documentary requirements shall be submitted to the respective Revenue District Office where the donor and the donee-recipient are registered, in accordance with the form attached, within sixty (60) days from the lifting of the ECQ.

Donations/gifts to foreign institutions or international organizations shall not be subject to the documentary requirements enumerated under Section 6 of these regulations but shall be subject to the verification rules under Section 34(H)(4) of the NIRC. Donations of all critical or needed healthcare equipment or supplies and relief goods shall not be treated as a transaction deemed sale subject to Value-Added Tax (VAT) under Section 106 (B) of the NIRC, as amended. Furthermore, any input VAT attributable to such purchase of goods shall be creditable against any other output tax The Regulations shall take effect starting March 16, 2020 upon issuance of Presidential Proclamation No. 929 and shall be in full force only during the three (3) month effectivity of RA No. 11469, unless extended or withdrawn by Congress or ended by Presidential Proclamation.