By: Maxfield Brown

By: Maxfield Brown

In a victory that stunned analysts around the world, the UK has voted to exit the European Union (EU) by a margin of 52 to 48 percent. In addition to producing significant implications for investors across Europe, the interconnected nature of the global economy leaves businesses across the world exposed. ASEAN is no exception. Currency markets within the South East Asian bloc have already seen swift valuation changes, and the pending exclusion of the UK from the EU’s network of trade negotiations in ASEAN is likely to have a long term impact on trade within the region.

For European investors maintaining operations throughout ASEAN or British parties considering investment, it will be of utmost importance to monitor developments within the region closely in order to ascertain their likely exposure to Brexit fallout.

Short-Term Considerations: Foreign Exchange Volatility

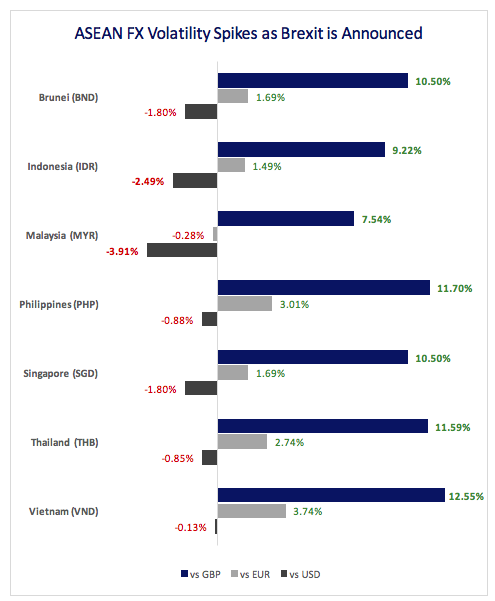

As markets within ASEAN know all too well, currency volatility is one of the most immediate externalities associated with economic crisis. Despite the Pound Sterling being separated from the Euro, the mere threat of a Brexit was enough to depreciate the Pound by 7 percent against the US dollar during voting. As polls closed, ASEAN currencies have also seen substantial rises in their value against the United Kingdom.

For those purchasing goods or servicing debts within the UK or using British Pounds as a medium of denomination or exchange, the prevailing headwinds within currency markets strongly favor currencies from within ASEAN. In the near term, this will allow consumers to purchase goods from UK based suppliers at a significant discount, however, it will also curtail the ability of British based consumers to purchase goods from a variety of markets including those within ASEAN. This is likely to constrain liquidity of British buyers and runs the risk of disrupting existing purchase agreements that these parities may have signed with ASEAN based suppliers.

While the British Pound has been hit hardest by its exit from mainland Europe, Brexit has created significant tensions within the Eurozone as a whole and decreased confidence that the Euro will continue to be used within the region. Reflecting these concerns, all currencies within ASEAN have appreciated significantly against the Euro with the exception of Malaysia. Investors flooding out of the Eurozone have instead taken refuge in Dollar denominated assets resulting in an appreciation of the US dollar against ASEAN markets.

Although muted when compared to the Pound, the movement of the Dollar and Euro will have tangible impacts on the cost of goods being purchased and sold to these markets. Exports to the European Union will likely see reduced demand as cost adverse Eurozone buyers are priced out of ASEAN markets. Buyers from within ASEAN on the other hand will benefit from discounted Eurozone goods brought on by the relative rise in their home currencies. Those exporting to US markets will likely see demand increase, with countries such as Malaysia and Indonesia particularly well positioned to benefit.

A final area of consideration for investors should be those nations within ASEAN that have chosen to control their currencies. Given the large volatility and volume of trading in international markets, countries such as Laos, Myanmar, and even Vietnam may struggle to maintain steady parity with the Pound and other currencies such as the US Dollar.