Pag – IBIG Press Release

By Management

Pag – IBIG Press Release

By Management

By Management

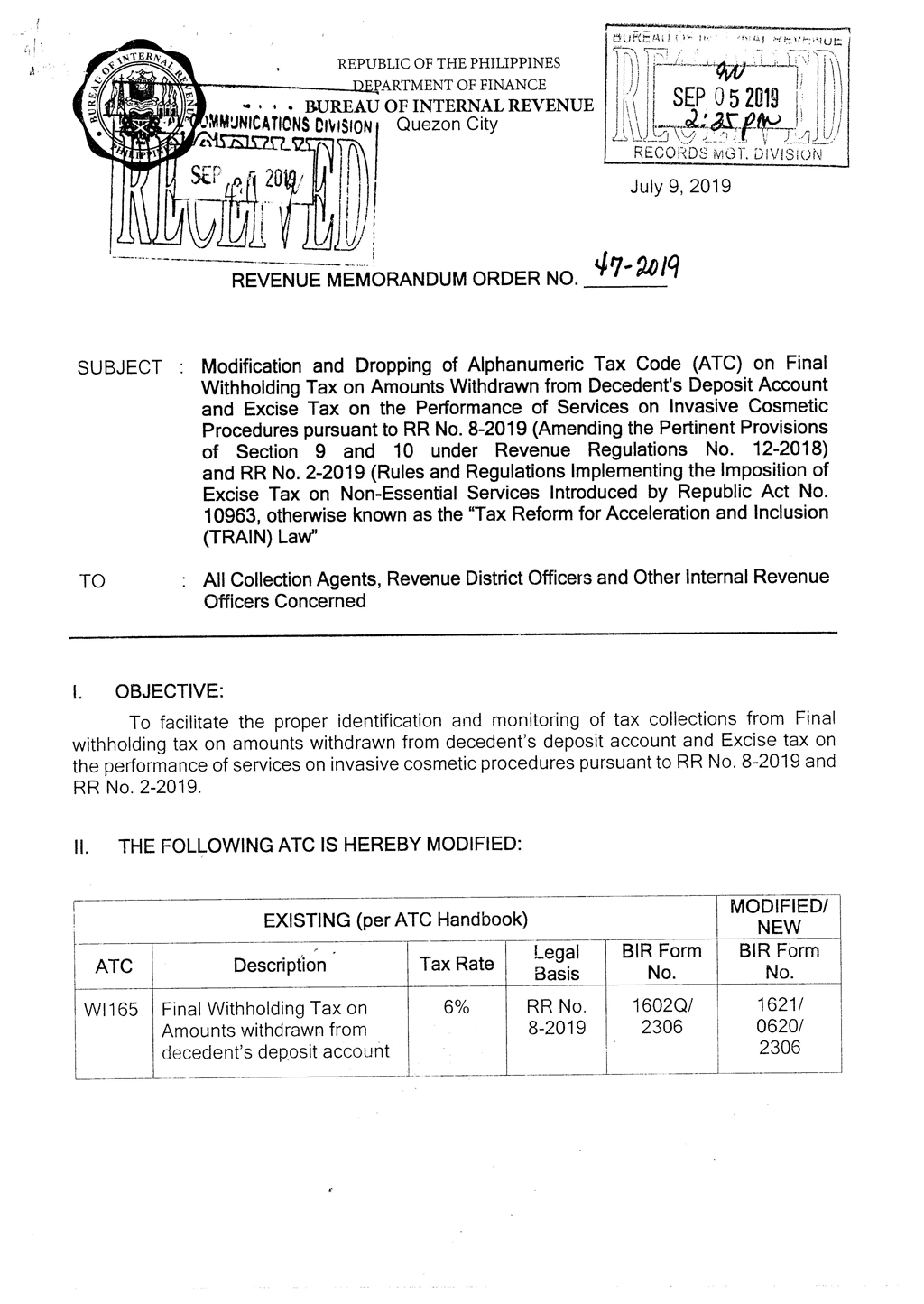

BIR Revenue Memorandum Order No. 47-2019

Modification and Dropping of Alphanumeric Tax Code (ATC) on Final Withholding Tax on Amounts Withdrawn from Decedent’s Deposit Account and Excise Tax on the Performance of Service on Invasive Cosmetic Procedures pursuant to RR No. 8-2019 (Amending the Pertinent Provision of Section 9 and 10 under Revenue regulations No. 12-2018) and RR No. 2-2019 (Rules and Regulations Implementing the Imposition of Excise Tax on Non-Essential Services Introduced by Republic Act No. 10963, otherwise known as the “Tax Reform for Acceleration and Inclusion (TRAIN) Law”

By Management

BIR Revenue Memorandum Circular No. 93-2019

Amending the Answer to Question No. 2 of Revenue Memorandum Circular (RMC) No. 85-2018 Relative to the Issuance of Electronic Certificate Authorizing Registration (eCAR) in the Transfer of Real Properties.

By Management

BIR Memorandum Circular No. 92-2019

Publishing the Full Text of the Republic Act No. 11346 which was approved by President Rodrigo Roa Duterte last July 25, 2019 entitled “AN ACT INCREASING THE EXCISE TAX ON TOBACCO PRODUCTS IMPOSING EXCISE TAX ON HEATED TOBACCO PRODUCTS AND PRODUCTS, INCREASING THE PENALTIES FOR VIOLATIONS OF PROVISIONS ON ARTICLE SUBJECT TO EXCISE TAX , AND EARMARKING A PORTION OF THE TOTAL EXCISE TAX COLLECTION FROM SUGAR-SWEETENED BEVERAGES, ALCOHOL, TOBACCO, HEATED TOBACCO AND VAPOR PRODUCTS FOR UNIVERSAL HEALTH CARE, AMENDING FOR THIS PURPOSE SECTION 144, 145, 146, 147, 152, 164, 260, 262, 263, 265, 288, AND 289, REPEALING SECTION 288(B) AND 288(C), AND CREATING NEW SECTION 263-A, 265-B AND 288-A OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED BY REPUBLIC ACT NO. 10968, AND OTHER PURPOSES.”