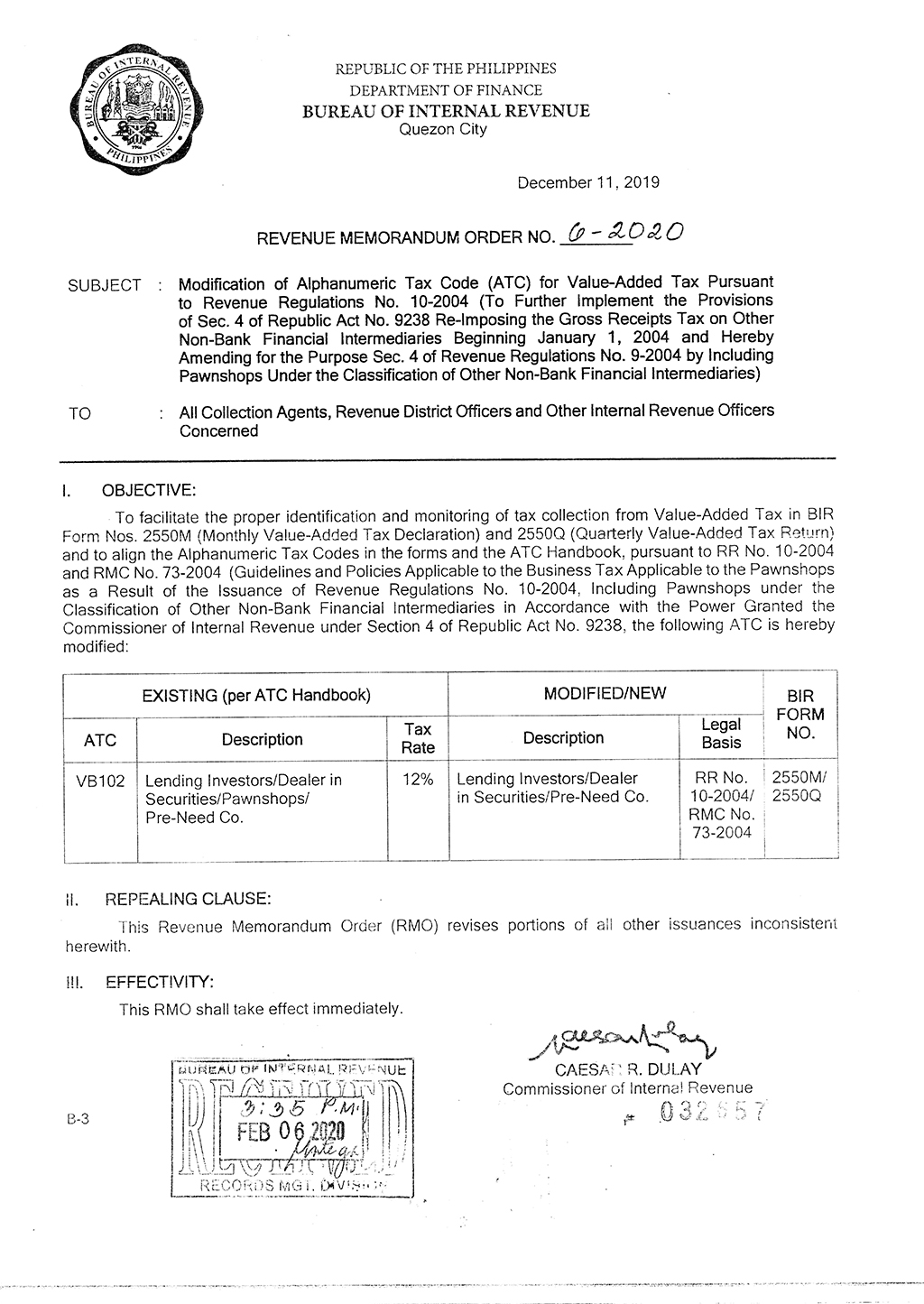

BIR Revenue Memorandum Order No. 6- 2020

Modification of Alphanumeric Tax Code (ATC) for Value-Added Tax Pursuant to Revenue Regulations No. 10-2004 (To Further Implement the Provision of Sec. 4 of Republic Act No. 9238 Re-Imposing the Gross Receipts Tax on Other Non-Bank Financial Intermediaries Beginning January 1, 2004 and Hereby Amending for the Purposes Sec. 4 of Revenue Regulations No. 9-2004 by Including Pawnshop Under the Classification of Other Non-Bank Financial Intermediaries)