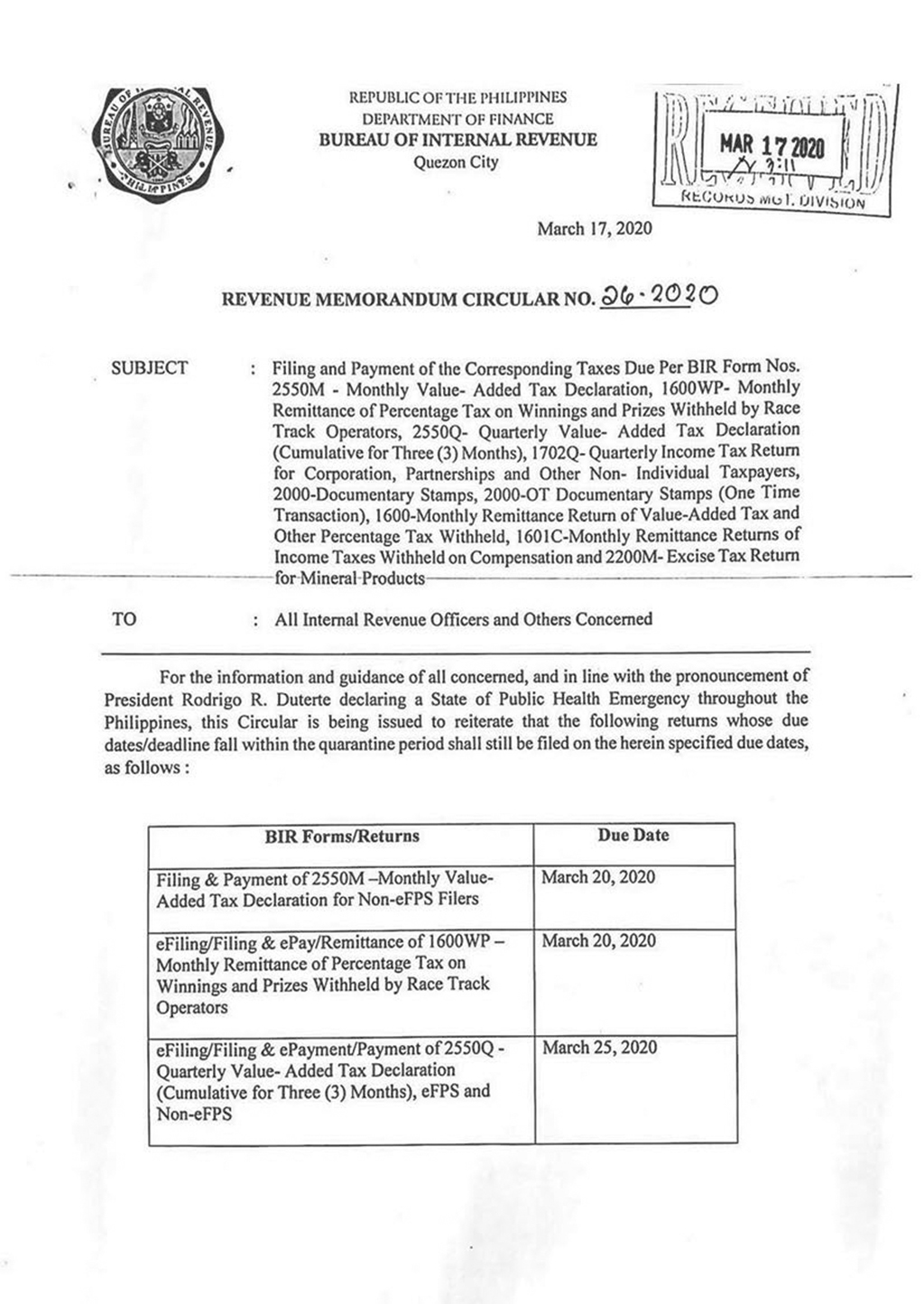

SEC Memorandum Circular No. 9 Series of 2020

Guidelines for the filing of the General Information sheet (GIS) During the COVID-19 Outbreak and Enhanced Community Quarantine

By Management

By Management

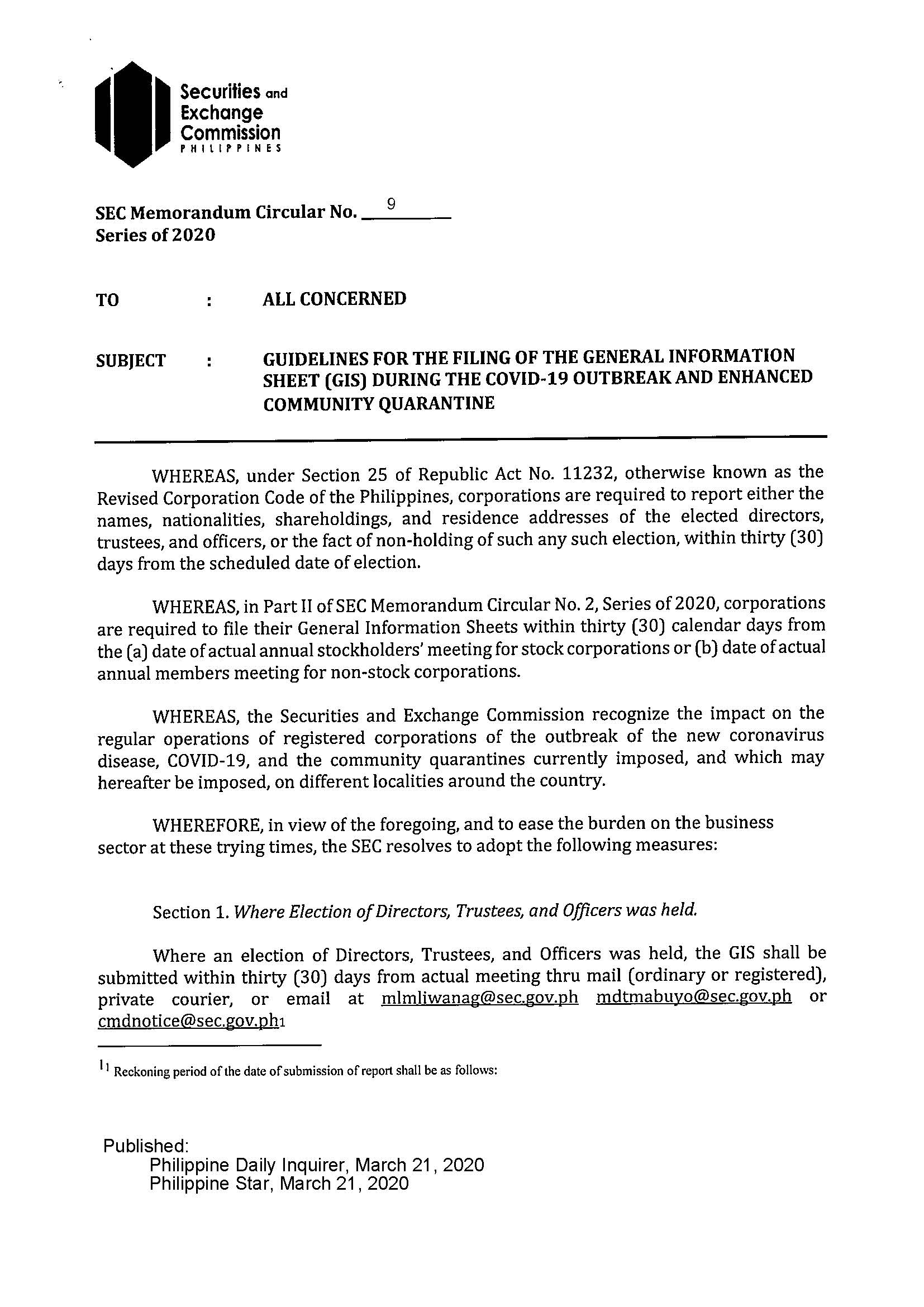

BIR Advisory

By Management

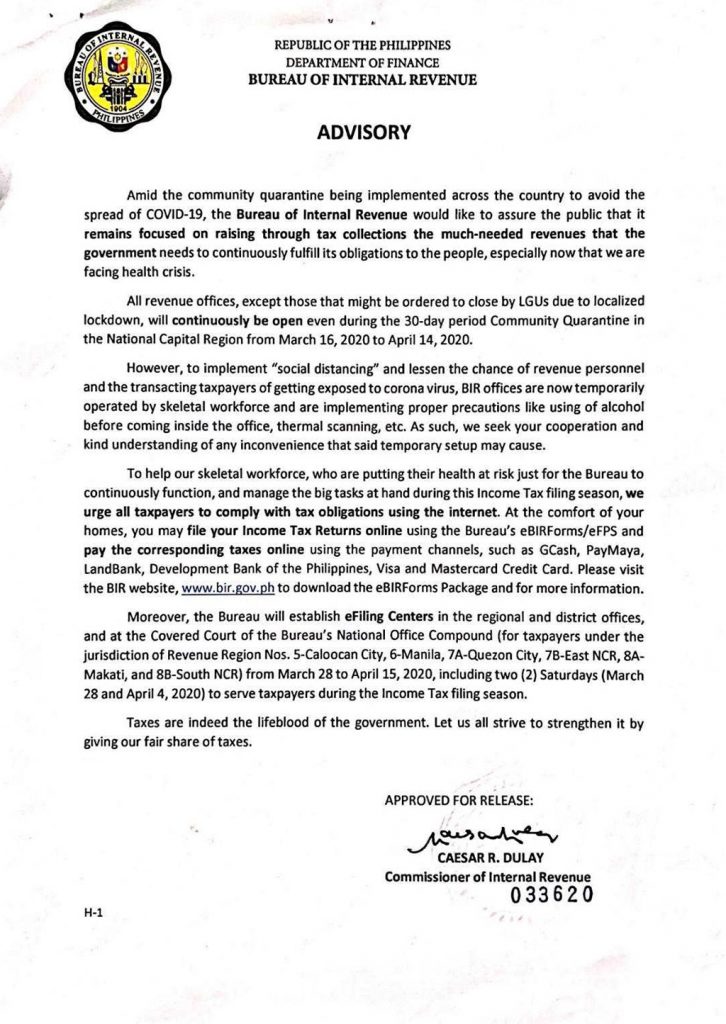

SEC Advisory – 17 March 2020 (2)

By Management

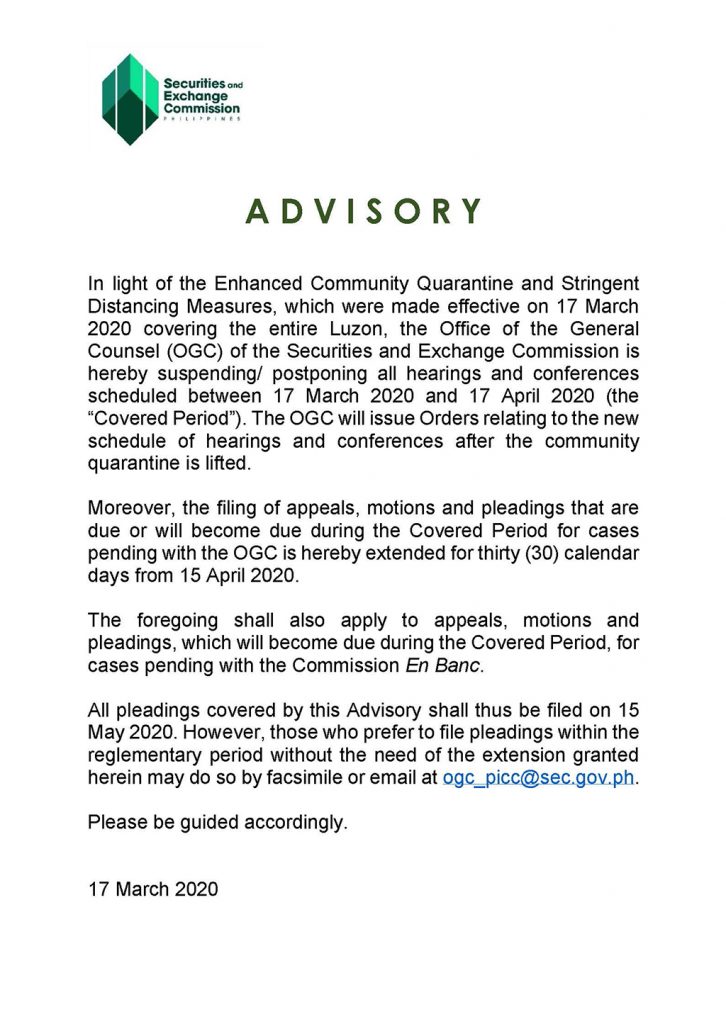

SEC Advisory – 17 March 2020

By Management

BIR REVENUE MEMORANDUM CIRCULAR NO. 26 – 2020

Filing and Payment of Corresponding Taxes Due Per BIR Form Nos. 2550M – Monthly Value- Added Tax Declaration, 1600WP – Monthly Remittance of Percentage Tax on Winnings and Prizes Withheld by Race Track Operators, 2550Q- Quarterly Value- Added Tax Declaration(Cumulative for Three(3) Months), 1702Q- Quarterly Income Tax Return for Corporation, Partnership and Other Non- Individual Taxpayers, 2000-Documentary Stamps, 2000-OT Documentary Stamps (One Time Transaction), 1600-Monthly Remittance Return of Value-Added Tax and Other Percentage Tax Withheld, 1601C-Monthly Remittance Returns of Income Taxes Withheld on Compensation and 2200M-Excise Tax Return for Mineral Products