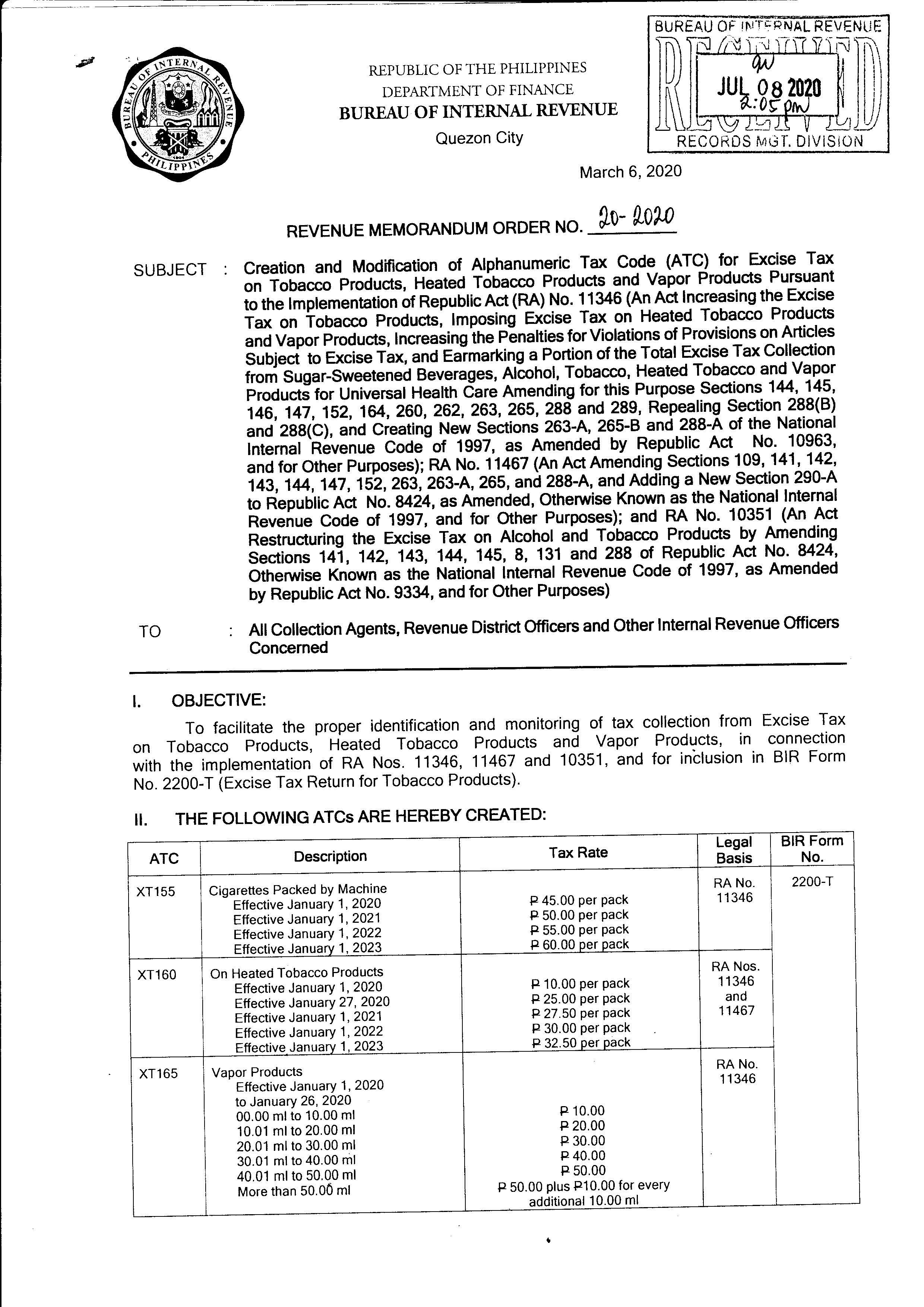

REVENUE MEMORANDUM ORDER NO. 20-2020

Creation and Modification of Alphanumeric Tax Code (ATCJ) for Excise Tax

on Tobacco Products, Heated Tobacco Products and Vapor Products Pursuant to the implementation Republic Act (R.A) No. 11346 (An Act Increasing the Excise Tax on Tobacco products, lmposing Excise Tax on Heated Tobacco Products and Vapor Products, Increasing the Penalties for Violations of Provisions on Article Subject to Excise Tax, and Earmarking a Portion of the Total Excise Tax Collection from Sugar-Sweetened Beverages, Alcohol, Tobacco, Heated Tobacco and Vapor Products for Universal Health Care Amending for this Purpose Sections 144, 145, 146, 147, 152, 164, 260, 262, 263, 265, 288 and 289, Repealing Section 288 (B) and 288(C) and Creating New Sections 263-A, 265-B and 288-A of the National Internal Revenue Code of 1997, as Amended by Republic Act No. 10963, and for Other Purposes); RA No. 11467 (An Act Amending Sections 109, 141, 142, 143, 144, 147, 152, 263, 263-A, 265, and 288-A, and Adding a New Section 290-A to Republic Act No. 8424, as Amended, Otherwise Known as the National Internal Revenue Code of 1997, and for Other Purposes); and RA No. 10351 (An Act Restructuring the Excise Tax on Alcohol and Tobacco Products by Amending Sections 141, 142, 143, 144, 145, 8, 131 and 288 of Republic Act No. 8424, Otherwise Known as the National Internal Revenue Code of 1997, as Amended by Republic Act No. 9334, and for Other Purposes)