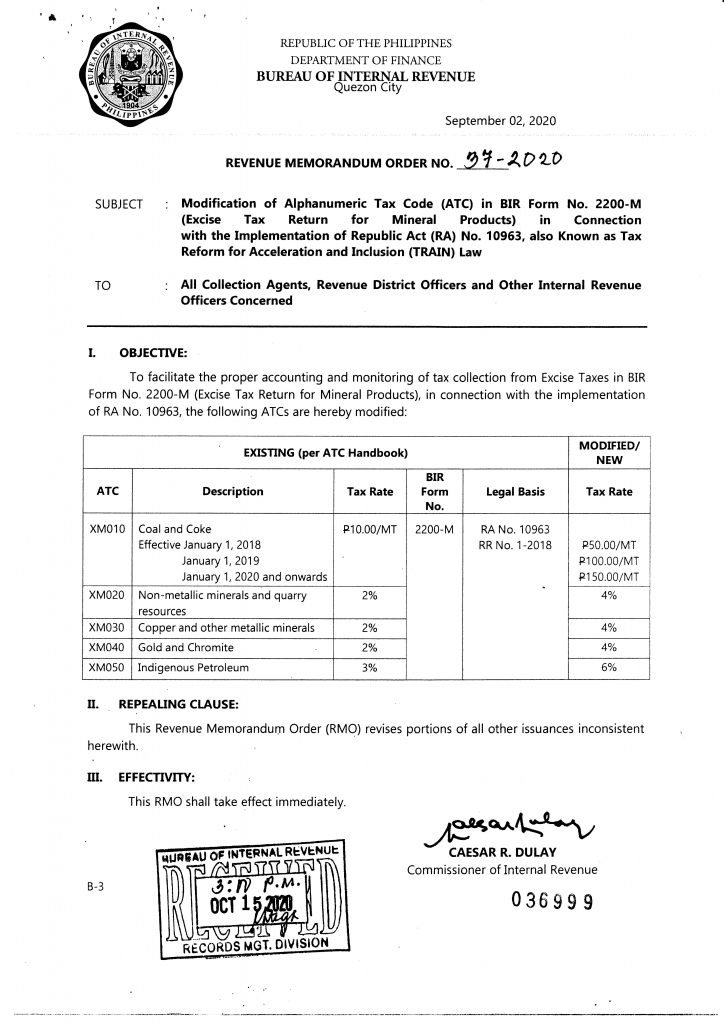

BIR Revenue Memorandum Order No.37-2020

Modification of Alphanumeric Tax Code (ATC) in BIR Form No. 2200-M (Excise Tax Return tor Mineral Products) in Connection with the Implementation of Republic Act (RA) No. 10963, also Known as Tax Reform for Acceleration and Inclusion (TRAIN) Law