By: Dezan Shira & Associates

Editor: Maxfield Brown

Thailand – Business Collateral Act

Starting on July 2, 2016, small and medium sized enterprises in Thailand will be provided greater access to loans within the Kingdom. As part of the Business Collateral Act, passed in November of 2015, the scope of currently available credit lines will be broadened while at the same time ensuring those providing loans with the ability mitigate increased risk exposure.

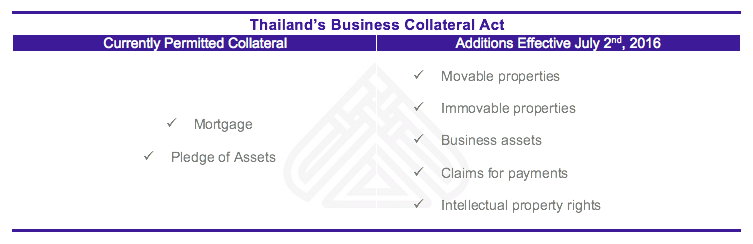

For businesses currently seeking financing, restrictions on collateral within Thailand have been a serious impediment to the acquisition of funding. Under existing laws, the only collateral options available include mortgaging under very limited circumstances or a pledge system that surrenders assets to the lender during the duration of repayment.

A major component of BCA is its expansion of collateral options to allow for companies to make better use of their assets during repayment and to give businesses a greater variety of collateral options. The chart below contrasts the current and upcoming policies: While the BCA is sure to increase the availability of capital to growing businesses throughout the country, Dezan Shira & Associates would like to draw investors’ attention to a number of restrictions, penalties, and compliance requirements that have been placed on the financing process:

While the BCA is sure to increase the availability of capital to growing businesses throughout the country, Dezan Shira & Associates would like to draw investors’ attention to a number of restrictions, penalties, and compliance requirements that have been placed on the financing process:

- Receiving Collateral: Financial institutions are the only actors permitted to receive collateral under the BAC.

- Business Collateral Agreements: Required for all collateral arrangements. All Agreements must be registered with the Business Collateral Registration Office.

- Preferential Claims: Pursuant to Business Collateral Agreements, those providing loans and receiving collateral shall have preferential claim over these assets. Claims will remain valid even if the assets in question have been transferred to a third party.

- Violations: any divulgence of confidential information, withholding of facts, or provision of false statements will be classified as a violation of the BCA. Punishments for these offenses can include fines and jail time of up to three years.